Patronage Rewards

Sharing Success: The Value of Local Banking

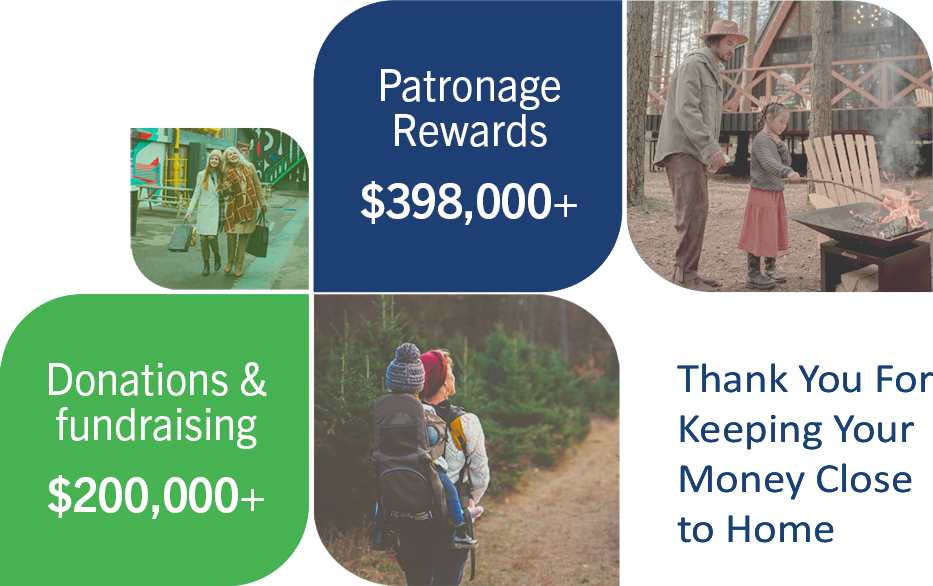

At StellerVista Credit Union, sharing success is one of our core values—it’s one major way that we set ourselves apart from the banks. We believe that when we thrive, our members and communities should thrive too. That’s why we’re proud to announce that in 2024, we returned over $480,000 to our members and the community through Patronage Rewards and Dividends.

This year, our Board approved more than $390,000 in Patronage Rewards, directly recognizing the trust and loyalty of our members. Additionally, $90,000 was distributed in Dividends, offering even more value to our membership. These payouts are a testament to the power of keeping profits local, reinvesting in our members and our communities instead of sending them away to national or global headquarters.

This is the unique value of being part of a credit union. Unlike the big banks, your money stays close to home, fueling local businesses, supporting community initiatives, and contributing to a stronger regional economy. When you bank like you live here, the impact goes further than you could imagine—not just for you, but for your neighbors and the place we all call home.

Thank you for being part of the StellerVista story. Together, we’re proving that success is best when it’s shared.

2023

Over $390,000 given back

2022

Over $400,000 given back

2021

Over $637,000 given back

2020

Over $243,000 given back

2019

Over $316,000 given back

What are Patronage Rewards?

Sharing success isn’t just something we believe in—it’s written into our policies. Every year, we strive to return as much of our profits to our members as possible. This commitment is built into our business model: the more we earn together, the more we can give back. In the last three years alone, we’ve returned over $1 million directly into our members’ accounts.

For 2024, Patronage Rewards were paid out and automatically deposited into eligible members’ accounts by December 31st. How much each member receives is based on key factors such as:

- Interest Paid on Loans and Mortgages – The more you borrow, the more you could receive back.

- Interest Earned on GICs – Your savings work harder with us, earning both returns and potential rewards.

- Service Fees Paid – Even routine banking can add to your annual Patronage payout.

This structure ensures that your relationship with StellerVista provides more value than you’d find at a traditional bank. Unlike national or global institutions that send profits elsewhere, our earnings stay local—reinvested in our members, our communities, and the local economy. It’s part of what makes local banking with us more impactful, rewarding, and affordable.

When you bank like you live here, you’re part of something bigger. Together, we’re building a future where success is shared, and everyone benefits.

Not a Member?

Community Matters?

Member Dividends

2023: $59,646 (A) - $31,111 (C)

- Patronage Rewards calculated on any non registered deposit accounts will be deposited in your A shares.

- Patronage Rewards calculated on registered accounts (RRSP/RRIF/LIF/TFSA) will be deposited to your registered savings accounts.

- Patronage Rewards calculated on month-end service charges will be on your November statement.

- Further information on eligibility and the calculation is available upon request. 1.250.426.6666.