Welcome to the StellerVista Newsletter!

If there is any topic you’d like covered in an upcoming newsletter, let us know by emailing info@stellervista.com – with the subject line “Newsletter”.

If there is any topic you’d like covered in an upcoming newsletter, let us know by emailing info@stellervista.com – with the subject line “Newsletter”.

This is always an exciting time of year, as we see the impact of our community investment programs—specifically StellerStudents and StellerImpact. StellerStudents, now in its second year, provides financial awards to support local students across all the communities we serve, helping to ease the burden of post-secondary education. From welding and pilot training to pre-med studies, we’re excited to support diverse individuals and educational paths that better prepare our communities for the future. With over $25,000 in student awards given out this year, and more than $200,000 in the past decade, we’re investing in tomorrow’s leaders and their aspirations.

Meanwhile, StellerImpact has just wrapped up its application process, aimed at supporting local non-profits and community projects with grants ranging from $1,000 to $5,000. While our team is diligently reviewing the applications to select final recipients, we’re thrilled to see the inspiring projects taking place across our region. It’s truly amazing, and while we can’t fund every initiative, we appreciate every effort. Stay tuned for the official announcement later this October, and good luck to everyone who has applied. Exciting times ahead!

Watch one success story from the StellerImpact program right here >

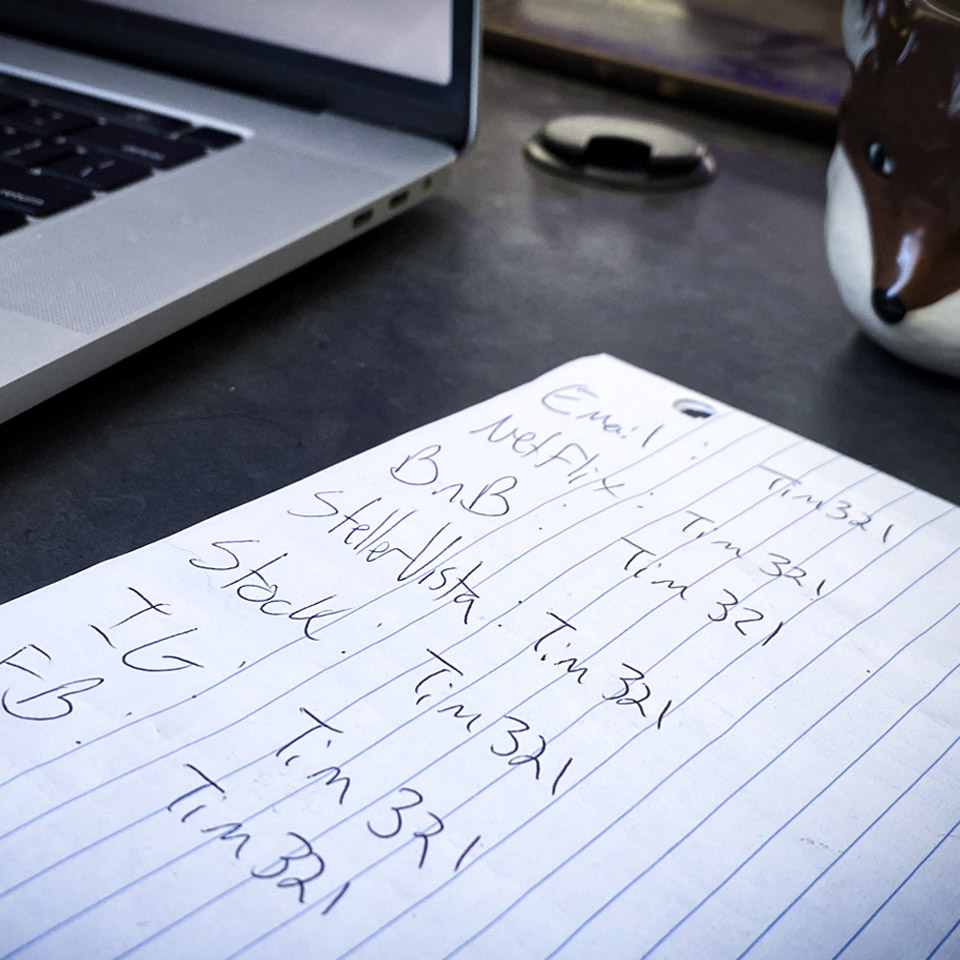

Everyone! We’ve all been told to use strong, unique passwords for every account and to avoid writing them down. But with the average person managing over 50 accounts—from email, social media, work and online shopping—keeping track of them all can be overwhelming.

Enter password managers. These tools securely generate, store, and manage your passwords in one place, protecting your data with robust encryption. Far more encrypted than your messy writing on that notepad holding all your passwords.

These tools offer a number of advantages and can help you create very complex passwords, autofill your login details across devices, and in general, simplify your digital life.

Some people worry about security or losing access if they forget their master password. However, password managers are designed to prevent these issues with features like password recovery options, two-factor authentication, and alerts for weak or compromised passwords. They can even securely store other sensitive information like credit card numbers and personal notes. While the initial setup may seem daunting, these tools are intuitive and user-friendly, making it easy to enhance your online security without much effort.

We’ve got more to say on the matter, and if you want to learn more about this and other digital security topics, click the link right here > www.stellervista.com/personal/banking/staying-safe

In an unpredictable world, the balance between want and need sometimes blurs, as too does the eye we keep on the total sum of our debt. From credit cards, to lines of credit, loans and other financing, it’s not uncommon to be not exactly sure how much interest and/or debt payments one is carrying each month.

Even if these items are completely manageable (but especially if it feels unmanageable), taking a good look at debt consolidation and debt management might save you more than the brain power it takes to add all these things together – it can also save you a lot of money.

By combining multiple payments into one manageable monthly amount, you reduce financial stress and save money with a lower interest rate. This simplified approach helps you regain control over your finances, improve your credit score, and make steady progress toward becoming debt-free.

If you would like to learn more on the topic, visit www.StellerVista.com/simplify